Faith, Work, and Economics

Southwestern Journal of Theology

Volume 59, No. 2 - Spring 2017

Managing Editor: W. Madison Grace II

The subject of this paper is the biblical basis for a God-ordained limited form of government (with limited taxation upon Israel) which changed drastically when Israel rejected God’s immediate rule and demanded an intermediary military deliverer/king in the events of 1 Samuel 8 (8–12). The original biblical standard of governance for Israel required an Israelite king to self-limit both his power and taxation (Deut 17). However, when Israel rejected God’s rule over them for the type of feudal kingship found in ancient Near Eastern city-states, God gave Israel over to be oppressed by the eventual expansion of kingly power and taxation at the hands of their kings. While this new pragmatic standard of kingship was, in reality, God’s judgment upon Israel concerning kingship (1 Sam 8:11–23), God’s standard for righteous kingship in Deut 17 remained the ideal.

We know what it is for men to live without government—and living without government, to live without rights . . . we see it in many savage nations, or rather races of mankind . . . no habit of obedience, and thence no government—no government, and thence no laws—no laws, and thence no such things as rights— no security—no property—liberty, as against regular controul, the controul of laws and government—perfect; but as against all irregular controul, the mandates of stronger individuals, none.1

The Kingship of God and Taxes

Governments make laws to affirm, establish, and regulate rights; and they establish taxes and penalties to regulate behaviors and gain revenue to both protect and provide services.2 Governmental authorities often claim to a moral impetus for their tax laws.3 When reviewing the laws with which God regulates the economic actions and/or requirements upon the Israelites, the moral impetus is easy to see. The Old Testament does not present a systematic review of all Israelite taxes nor a comprehensive review of whether and/or how they were collected, yet there is still much data with which to work. The performance of these taxes is presented in selected narrative texts (gleaning in Ruth; Head Tax census in 2 Sam, 2 Chr 31, Neh 10:32ff, etc.). Menachem Elon’s definition of taxation is a good place to begin, a “tax is a compulsory payment, in currency or in specie, exacted by a public authority, for the purpose of satisfying the latter’s own needs or those of the public, or part of the public.”4 Any laws imposed on Israel by God, whether social or religious in nature, which demanded the services, time, or goods of an Israelite are viewed here as taxes.

The kingship of God is expressed in many places within the Old Testament through His creation, judgment (flood), deliverance (plagues/red sea crossing), the covenants (Noahic, Abrahamic, Sinaitic, and Deuteronomic) and in many places by His worshippers. In the beginning, He delegated governance of the earth to mankind in the garden. God had man order/name the creatures and gave him a mate to co-rule with him. In the beginning all belonged to man, so collecting, gathering, keeping, and distributing goods was not necessary. Before the fall, there were very limited rules of governance imposed upon man (be fruitful, multiply, fill, rule, tend the garden, do not eat from the one tree, etc). In the garden no tithes, taxes, or sacrificial offerings to God are mentioned. Mankind’s sin resulted in a loss of governance, a loss of the garden (land), a cursed creation (ground), and a changed order of relationship (co-rule to direct rule—husband over wife). Mankind went from a righteous servant co-rule to an unrighteous self-centered self-rule (a simple and insipient form of the later feudal kingship exhibited across ancient Near astern history). After the fall they had to work for what they ate; for what they gained. As man multiplied, one man’s liberty could harm another as in Cain killing Abel. The violence and disorder, to which mankind descended, brought God’s judgment. So He revealed His judgment upon mankind and His salvation through his deliverance of Noah.

Ancient Near Eastern Kingship

After the flood kingship arose in the city-states of Mesopotamia and in Egypt. The ancient Near Eastern kings were at first military leaders chosen by elders and tribal leaders to deliver them from crises of invasion etc.5 Sometimes they chose one from outside their immediate circles (i.e. not from their people). Later, kingship became hereditary. These city-state kings were feudal in their approach. They gained lands and servants through oppressing the people through loans, usury, taxes, corvee labor requirements, and confiscation of lands. They raised men to the noble rank of charioteer (mariannu),6 just as in the knights of feudal Europe. In the end, the people were no more than serfs working for the king. The Israelites had direct contact and first-hand knowledge of the city-state kingship model both in the land of Canaan and in the surrounding nations.7 This type of kingship tended toward absolute monarchy. However there were some texts which indicate that some desired to limit the powers of kingship. One such text, called “Advice to a Prince,” promotes the good/limited governance presented in Deuteronomy 17. Likely written to protect the rights of the people, the prince is admonished to not: take the people’s silver, accept bribes, improperly convict, improperly show leniency to foreigners, fine the people, take their grain to give his horses/servants, confiscate their livestock, seize their sheep, or to impose corvee labor upon them.8 This shows the types of actions of which ancient city-state kings were actually involved.

Israelite Governance and Taxes

God had promised both Abraham and Sarah that kings would be among their descendants. Later, Jacob blessed his son Judah with rulership over his brothers (Gen 49:8–12), so future Israelite kingship was ordained by God to belong to Judah. It was within the Law of Moses that God’s view of how His people should be governed was revealed. As Israel fled Egypt they left a system of sovereign oppression and slavery where they had no rights. As they camped at Sinai, God presented to Moses their new order of government, under His rule as sovereign. As king of Israel, God imposed upon Israel a suzerainty covenant in the book of Deuteronomy which was their national constitutional covenant with Him.9 The Law presented to Israel God’s expectations of their rights and duties as His people. The Law revealed the boundaries of individual and corporate liberty and action.10 Some laws were likely codified cultural norms. Many were new to Israel. These laws established their rights and obligations while in many places limited their freedom.11 So Israel’s government was a voluntary theocracy with God as its Sovereign (Exod 24). It follows that the tithes/taxes which God imposed were related to the promised land since He is represented as owning the land with the Israelites only as sojourners there (Lev 25:23). Prior to entry into the land of Canaan Israel had no land, so their tax burden was low. Tithes of agricultural products were not yet in play. However, the festivals, Sabbath, sacrificial, and other economic tax laws were set in motion. Once they entered the land the agricultural taxes began.

Israel’s corporate and individual obligations, duties, and rights spelled out within the Law of Moses are here defined from the perspective of the Israelite landowner/taxpayer. What the law obligates an Israelite landowner to do for the poor man, from the perspective of the poor man could be regarded as a right.12 However, obligations are here defined as arising from laws requiring the Israelite to act in a prescribed manner toward others. Duties are defined as arising from laws requiring the Israelite to act in a prescribed manner toward God. Rights are defined here as being made up of two kinds: positive and negative rights. Many laws regard negative rights which protect the individual, or community, from the harm caused by the actions or interference of others (i.e. the right to live [i.e. not be killed], Exod 20:13, cf. 14–17). Some laws regard positive rights which oblige an individual (or the community) to take action on behalf of, or give something to, another person (Exod: 20:12, “honor your father and mother;” the offerings as the inheritance of the priests/Levites, Num 18:21; care for the poor, Deut 15:7ff; circumcision, Gen 17:10ff ). In the main, these are to be performed voluntarily by individuals, not imposed by the community or state. However, for an individual not to participate in these obligations, duties, or rights would bring, at times, severe penalties imposed by God or the community (not honoring parents=not living long in the land; not making offerings=rejection from the Israelite community; not supporting the poor=sin/not being blessed by God; uncircumcised males will be cut off from the Israelite community; not keeping the Sabbath=capital punishment, Num 15:32ff ).

The laws which relate to economic requirements and/or taxes are each considered as an obligation (to others), duty (to God), or positive right for the special class of the Levites and priesthood. The sacrifices and tithes, while duties to the Israelite, were presented by God in Numbers 18 as the inheritance (or positive rights) for the Aaronic priesthood and the Levites. Some sacrifices can be considered as duties to the Israelite since they were optional (i.e. sin offerings dependent upon the wrong action of the individual). Since these were only potential, they should not be considered a categorical positive right to the Priests/Levites. None of these tax laws promote negative rights.

Sin taxes in today’s usage are excise taxes on selected commodities. Sin offerings/taxes in Israel were taxes upon prohibited behaviors. In either case, the long term effect of these taxes is a reduction in the thing taxed.13 So through these types of offerings God is essentially taxing sin in order to: (1) raise awareness of the act as sinful, and (2) reduce its prevalence amongst the Israelites. The sustained cost of a sin habit would also expose individual behavior within the Israelite community. With Israelite guilt and repentance as well as communal membership requirements as motivating factors, the economic weight of sin laws/taxes should have worked toward reducing sinful behavior over time.

There were also regulations for taxing and sharing the spoils gained through warfare. When camped across the Jordan from Jericho, Israel was deceived into idolatry and sexual immorality with the Midianites. So God commanded Moses to call up twelve thousand men and strike Midian (Num 15:17–18). Following Israel’s defeat of the Midianites, God commanded a tax upon the spoils of war which these warriors had plundered (Num 31– 32). Half went to the warriors, half to the congregation and a little over one percent to the Lord as offerings (see Table 1). During David’s rule, he followed this pattern of sharing the spoils with those watching the supplies/ baggage as well as with tribal elders (1 Sam 30:24–26).

| Spoils | Total | Warriors portion (50%) | Israel’s Portion (50%0 | High Priest’s/ God’s Levy/ Tax on the Warriors’ portion (.2%)1 | Levite’s/ God’s Levy/Tax on Israel’s portion (2%)2 | Warriors Freewill Offering to God3 | God’s Percentage of the Total | Actual Spoils Per Warrior |

| Sheep | 675,000 | 337,500 | 337,500 | 675 | 6750 | 1.1% | 28 | |

| Cattle | 72,000 | 36,000 | 36,000 | 72 | 720 | 1.1% | 3 | |

| Donkeys | 61,000 | 30,500 | 30,500 | 61 | 610 | 1.1% | 2 to 3 | |

| Young Women | 32,000 | 16,000 | 16,000 | 32 | 320 | 1.1% | 1 | |

| Gold/ Jewelry | indetermi- nate | 100% | 0% | 0% | 0% | 16, 750 shekels | ? | ? |

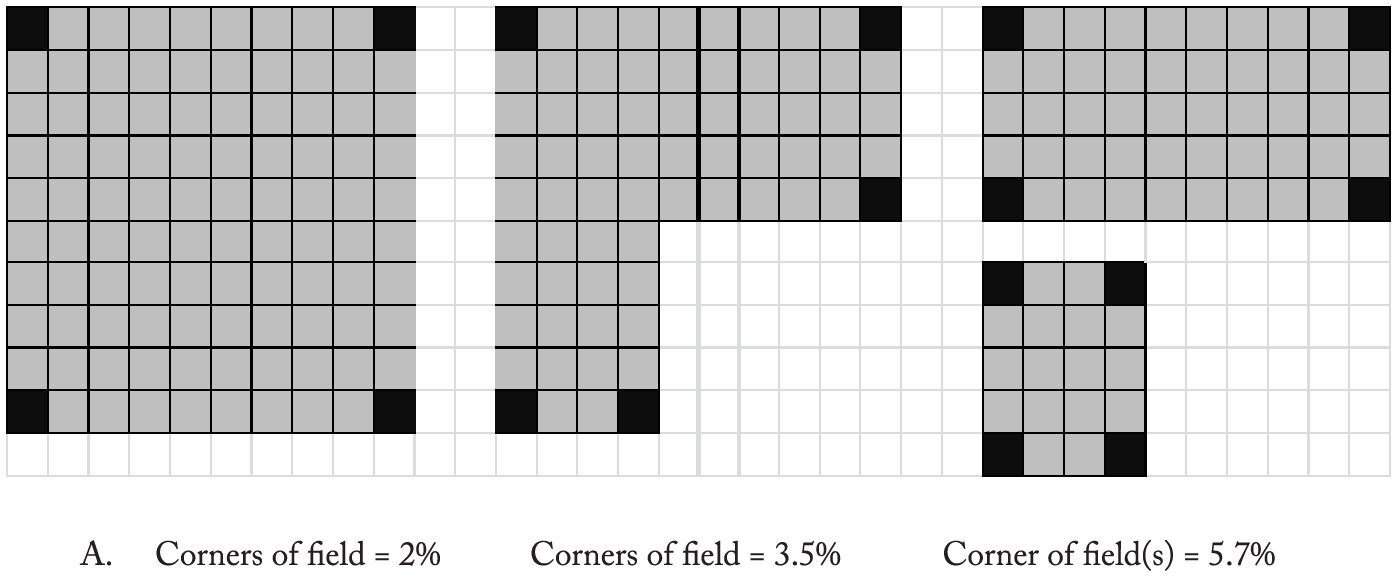

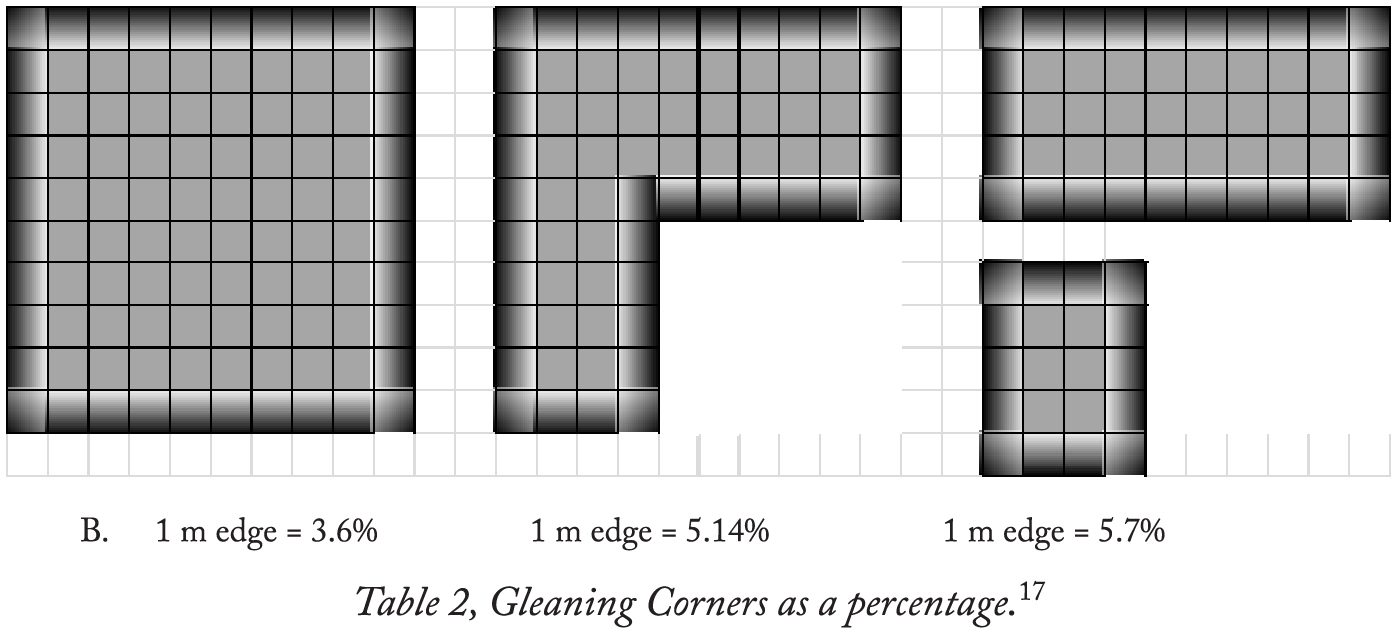

The average Israelite landowner’s taxes can also be categorized into a few simple categories by what is being taxed: Grain, Vine, Orchard (olive, fruit, nut, etc.), Beast (herd animals: oxen, donkeys, etc), Flocks (sheep, goats), Labor (Israelite, Servant, Strong servant), Lending, Cleansing, and Sin.14 Table 3 presents the total annual costs to the average Israelite landowner in the column “taxes before kingship.” The amounts were determined through analyzing the economic social and religious laws/taxes presented in the appendix. The actual amounts were in places fixed, but in other places were percentages and/or dependent upon other variables (actual production, size/ corners in fields, harvest dropped, head tax taken, loans made to Israelites, and cleansing or sin taxes necessary, etc.). For example in Table 2A., the images for gleaning the corners of a field demonstrate this variability. The large square field has the smallest area (and resulting lowest tax) in its corners—approximately 2%. The odd shaped field in the middle has less area but more corners and approximately 3.5% to be left unharvested. While the same area field physically separated into parts has even more corners and approximately 5.7% to be left unharvested. If the term ְׂשדָך ְּפַאת (Lev 19:9) means not corners but “edges of your field,”15 the percentage left to gleaning comes out a little differently (see Table 2B.). In this case, the actual percentage would vary according to how far from the edge was the appropriate distance to leave unharvested. Counting a one meter wide unharvested strip around the perimeter of a field, the percentages required for gleaning range from 3.6% to 5.7%. However, these numbers would be minimums, because some crops would be harvested and harvesters would have left unripened/late ripening grains or fruits in the field itself. This also does not include the other agricultural economic/gleaning taxes: dropped harvest, forgotten harvest, imperfect grape clusters, or fallen grapes/fruit.16

Table 2, Gleaning Corners as a percentage17

The total cost of the economic burden upon the average Israelite landowner was not that great. Compared to taxes upon the middle class today in the U.S.A. it is quite modest. Basically a ten percent income tax, a 10 % capital goods tax (flocks) and other minor or only potential taxes. There was a mandatory six-day workweek with another week of mandatory time off during the year. The sin taxes were even graduated for the poorer Israelite to be able to make a less costly payment (Lev 1:14).

Pre-monarchy taxation and tithing focused mainly on support for the priests, levites, and worship infrastructure—such as the poll/census tax, offerings, and voluntary gifts—as well as on providing for the poor. All of these taxes/tithes/offerings work toward the end of motivating the Israelites to love/honor God and love/help their fellow man.18 Biblical offerings might be viewed as proportionate taxes supporting priests and tabernacle. Gleaning, lending, Sabbatical Year, and Jubilee Year laws were essentially taxes that supported the poor, but their very nature also reduced the workload of the land-owner/taxpayer. In this instance, the tax and distribution were proportionate to the property held. For the most part, the tax burden was not applicable to the poor, or to non-agricultural work. So the poor and urban areas were not as heavily taxed.

The Lord made provision for taxes/tithes to be collected by the Levites (as in Num 18:25; cf. Neh 10:37–38; 12:44; 13:5) and every third year the tithe was to be brought to the Levites—likely at their local levitical cities (Deut 14:29). In other years, the Israelites were told to bring their tithes to the place “where God causes His name to dwell” for collection (Deut 12:6–11). The offerings were to be brought to the priests there as well (Lev 2:8). Later, the Levites were given charge of the tithes and consecrated things brought into the temple (2 Chron 31:11–12). The tithes were likely brought in at each festival. Annually, the poor worked the fields to collect the gleaning tax themselves.

In Israel, the people at first looked to their elders for leadership and later for justice.19 The regulations for governing Israel found in Deuteronomy promoted several functions of governance (justice, atonement, protection, and guidance). Israelite government was focused initially on judges, priests, and tribal leaders/elders (Deut 16–18). As a theocracy, Israel had both civil and religious leadership roles mixed within its charter. The roles of Leader/ Judge, Priest, Levite, Prophet and later King were all viewed both as servants of God and of the people. The laws concerning these leaders and the simple demands upon them for ethical governance and leadership are spelled out clearly. However, each type of leader was eventually shown to be capable of corrupt practice ( Judges like Samson, priests like Eli and sons, The Levite as priest for Dan, the old prophet in 1 Kings 13). Even before Israelite kingship was begun Israel’s leadership had become twisted.

The Rise of Israelite Kingship

The deuteronomic covenant allowed for human Israelite kingship. Moses stated that an Israelite king must: (1) be God’s choice, (2) be an Israelite not be a foreigner, (3) not multiply horses, (4) not let the people return to Egypt, (5) not multiply wives or his heart would turn away from God, (6) not increase silver and gold, (7) write, read, and keep the Law, (8) Fear the Lord God, and (9) not to lift his heart above his countrymen (Dt 17:14–20). However, this role was not immediately filled upon entering the land. Israel was sporadically led by varied military leader-judges as Israel’s obedience to God waxed and waned over several centuries. The author of the book of Judges made a clarion call for kingship because there was no consistent leadership ( Judg 17:6; 18:1; 19:1; 21:25). However this call for human kingship was not to deliver Israel from its enemies but to lead them into acting according to God’s covenant; and so deliver them from their own self-centered, sinful, and idolatrous actions. When some of the people wanted to make Gideon their king, he recognized that it was the Lord who ruled over Israel ( Judg 8:23).

In the book of 1 Samuel God is presented as God, King, and Deliverer of Israel in chapters 1–7. In an interesting crossing pattern, God raises the lowly barren Hannah (giving her a prophet/son) and lowers Peninnah (2:5). God judges Eli and sons as wicked and raises Samuel as upright and knowing God. God humbles Israel before the Philistines, humbles the Philistines in His ark travels (1 Sam 5), and then raises up/delivers Israel through the prayer of His old prophet in chapter 7. Then in chapter 8 Samuel is the old judge with corrupt sons, but by chapter 12 he is vindicated as God’s spokesman and kingmaker. So in 1 Samuel 8 the elders request for a king was ostensibly to remove Samuel (and his sons) from the governing role of judging/justice (1 Sam 8:6). However, it was really another function of government which they desired—a military protector against Ammonite invasion (1 Sam 8:20; 12:12).

The elders demand for a king “Like the nations” essentially would remove God from His role as direct military protector of Israel and was deemed by God as an idolatrous rejection of His rule (1 Sam 8:7–8). This “king like the nations” was not about “let us have a king so that we will be ‘like’ other nations that have kings,” but “let us have and serve a king ‘like the nation’s kings/kingship.’20 This was a breach of the covenant in Deuteronomy 17. In response, to their request, God speaks to Samuel a commissioning/ judgment speech presented in two parts. The first part is God’s explanation to Samuel of the idolatrous nature of the request (1 Sam 8:7–9) which included God’s plan to test the people by having Samuel report to them the “Judgment concerning the King”21 (ֶלְך ֶּמ ַה ַּפט ְׁש ִמ ) to see if they would press for their demand for a king. This second part is presented in Samuel’s speech to the people.

| Types of Taxes | Taxes before Kingship | Taxes added by 1 Sam 8 Kingship |

| Grain Taxes—Festivals | 9.6 qt flour [6.4 qt flour as 2 loaves of bread] + 1 sheaf of grain | |

| Grain Taxes—Tithes | 10% of increase | 10% of increase=20% |

| Grain Taxes—Sacrifices | 1 bread cake per crop of grain [3.2 qt flour] | |

| Grain Taxes—Other | 3.5 to 6% gleaning, + dropped harvest, don’t muzzle ox | best fields |

| Vine Taxes—Festivals | 1 qt wine [1/4 hin] | |

| Vine Taxes—Tithes | 10% of increase | 10% of increase=20% |

| Vine Taxes—Other | dropped harvest | best vineyards |

| Orchard Taxes—Festivals | oil [to mix in flour – firstfruits offering] | |

| Orchard Taxes—Tithes | 10% of increase | |

| Orchard Taxes—Other | 100% produce of the 3rd/4th yr of planted tree | best orchards |

| Labor Taxes—Festivals | 2.17% [1.9% (7 days no work)+.27% (1 day building booth)] | |

| Labor Taxes—Sabbath | 14.28% [reduction in work] | Corvee Labor – servants [at times 33%] |

| Labor Taxes—Other | goods to freed bondservant, 1/2 shekel head tax, parapet | for Male/female/strong male/beasts |

| Beast Tax—Tithes | 10% of herd | |

| Beast Tax—Sacrifices | 120% of cost to redeem animal | |

| Beast Tax—Other | kill firstborn or lamb, or 5 shekels | |

| Lending Tax—Yearly | loss of interest to Israelites, bad debt risk | |

| Flock Taxes—Festival | 3 male lambs | |

| Flock Taxes—Tithes | 10% of total herd/flock | 10% of herd/flock=20% |

| Cleansing Taxes—Woman/man | 24 turtledoves/pigeons [@ 2 per month per couple] | |

| Sin Taxes—Optional | ||

| Flock—Guilt Offering | 2 lambs/goats/birds+1/10 ephah flour | |

| Flock—Guilt Offering with compensation | 1 ram+120% of value of profaned item | |

| Flock—Sin Offering | 1 female goat/lamb | |

| Flock—Atonement | 1 bull/ram/turtledove/pigeon | |

| Grain—Offering | fine flour with salt, oil, & frankincense | |

| Cleansing Tax—Leper | 2 clean birds, 2 male lambs a female lamb+ephah of flour w/oil | |

| 7th Yr Taxes | ||

| Labor Taxes—Sabbath Year | [100% @ 1yr – offset by God’s blessing in 6th yr] | |

| Lending Tax—Sabbath Year | loss of principal | |

| Jubilee Taxes | ||

| Labor Taxes—Jubilee | [100% @ 2 yrs – offsett by God’s blessing in 6th yr] |

This type of ָּפט ְׁש ִמ , found here in 1 Samuel 8, is similar to that mentioned in Deuteronomy 17:9–11 which speaks of the people coming to the judge to inquire about a verdict. The judge is to declare the verdict (v. 9) and the people are to observe the verdict/oral judgment (v. 11, ָּפט ְׁש ִמ ).

God’s Commissioning / Judgment Speech:

Part 1: God to Samuel

Introduction: to the Commissioning of the Messenger: (“Obey the voice of the people for” v. 7)

Reason for Judgment:

Accusation (“they have rejected me,” v. 7)

Development (“as all the things” v. 8)

Commissioning of Messenger: (“Obey their voice only” v. 9a)

Reason for Messenger:

Accusation (Testify, v. 9b)

Development (Proclaim the mišpāṭ hammelek, v. 9c–d)

Part 2: Samuel to the “Ones Asking for a King”

Report of Messenger’s Speech: (Testify [vv. 7–9], v.10a–11a)

Announcement/Messenger Speech:

Intervention of God

(“This will be the mišpāṭ hammelek,” v. 11b–c)

Results of God’s Intervention/Judgment (vv. 11d–18c) 22

In this judgment, God warns Israel of the worldly standard of ancient Near Eastern city-state kings (expansive oppressive government and taxation, including corvee labor)—the type of king for whom they were clamoring.

The ֶלְך ֶּמ ַה ַּפט ְׁש ִמ (1 Sam 8:10–18) is a parodic satire upon the elders request for a king. A parody is a form of sarcastic satire that imitates its literary object by exaggeration in order to ridicule it.23 Samuel’s judgment speech parodies the kingship passage in Deuteronomy 17:14–20 (see Table 4.) but is not ridiculing it. There is satire involved here as well. Biblical satire takes a high moral tone and reproaches a real and current deviation of a covenantal norm (in order to reform that deviation).24 So put together this judgment speech is a parodic satire upon the elders request for a king which reflects the ideal kingship text of Deuteronomy 17, but which reproaches the request as a deviation from the covenant with God. In it, God’s prophet tries to restrain the people from pressing their request by reporting to them both the nature of the kingship for which they are asking and the resulting state in which they will find themselves serving such a king. It is also argued here that the judgment speech, as it is reported by God to be a serious breach of the covenant (1 Sam 8:8), is also intertextually recalling the covenant curses of Deuteronomy 28. These concepts are presented in 1 Samuel 8 in the following order:

14–15: if you follow other gods, these curses will overtake you

32, 41: your sons and daughters taken into captivity

33: a people you do not know will eat the produce of your ground

38: you will plant fields, vineyards, and olive orchards but will not eat of it

49, 31: a nation will come eat your herds, grain, wine, oil, and produce . . . your ox, donkey and sheep will be taken and given away to enemies

48: you will serve your enemies

68: you will be taken to Egypt and offer yourselves as slaves

31: no one will save you

36: the Lord will bring you and your king to exile and you will serve idols

43: foreigners will lord it over you, you will be indebted to them

45: these curses will overtake you because you would not obey God.

| Deuteronomy 17:14–20— “A King who is an Israelite” | 1 Samuel 8 — “A King like the Nation’s Kings” |

| 14–15 An Israelite king to rule . . . not a Foreigner | 5 A pagan-style king/military leader4 |

| 16 He will not multiply horses | 11 He will take your sons for Chariot drivers, horsemen, messengers, and officers. |

| 17 He will not multiply wives | 13 Your daughters he will take for perfumers, cooks, and bakers—these are all tasks performed by concubines and wives for the kings court. |

| 17 He will not greatly increase silver and gold | 14–17 He will take your best fields, vineyards, and olive groves and give them to his servants He will impose a 10% tax on your grain, grapes, and other harvests to give to his servants He will take your male and female servants, as well as the best of your strong young workers and beasts of burden to do his work.5 He will impose a 10% tax on your flocks of sheep and goats |

| 20 He will study the Law, Fear God, and His heart will not be lifted up above his fellow Israelites | 17 You will be his slaves |

| 15 He will be chosen by The Lord God to serve as a vassal king | 18–20 Chosen/demanded by Israel to replace God as king |

So this “king like the nations” that they demand will “take, and take, and take” from them until they will end up as his slaves. He will be far worse for them than both an invader (like Nahash the Ammonite) who takes and leaves or judges who take only bribes (Samuel’s sons). This will be a serious expansion of governmental power and taxation.

God gave Israel a choice to trust God and live under His limited government (and limited taxation—with protection from enemies dependent upon their faith in God), or to trust in a king “like the nations’ kings” (with a standing army for protection, tyrannical oppression, subjective justice, extreme taxation, and eventually debt slavery of the people). If they pressed this demand for kingship, as God’s judgment for their rejection of Him they would get an ancient Near Eastern type of king and not the benevolent, humble leader found in the laws on kingship in Deuteronomy 17. Also, if they did trust in an earthly king, they would still rise or fall on the character of their king’s maintenance of their covenant relationship with God (1 Sam 12:22–25). The people’s response, an emphatic “No, but there shall be a king over us, that we also may be like all the nations, that our king may judge us and go out before us and fight our battles” (1 Sam 8:19–20).

When the people disregarded God’s warning/judgment and adamantly demanded this type of king, the oppressive governance and taxation of kingship became a pragmatic standard for governance which was implemented by good and bad kings throughout Israel’s history and with which God rarely interfered (1 Sam 8:18).

The first king Saul (lit. “the one asked for”) reflected God’s judgment upon Israel quite well.25 He governed in manner of ancient Near Eastern kings. Saul took: (1) men for his army (1 Sam 13:2; 14:52; 18:2), (2) men as commanders (1 Sam 14:50; 18:12; 22:7) (3) men to oversee and work his lands and livestock (1 Sam 21:7; 2 Sam 9:2–13), (4) men as servants (1 Sam 16:15, 18), (5) women for perfumers, cooks, and bakers (2 Sam 3:7), (6) fields, vineyards, and wealth for his military retainers/servants (1 Sam 17:25; 22:7), and (7) a tithe/tax of produce and livestock (1 Sam 17:25; 1 Sam16:20). Saul also offered “tax free” status to his favorite servants (as offered to the one who would kill Goliath, 1 Sam 17:25).

Solomon is perhaps the best prototype for the judgment concerning kingship in 1 Samuel 8. Solomon took: (1) men for his army (1 Kgs 9:22), (2) men as commanders (1 Kgs 2:35, 1 Kgs 9:22), (3) men to oversee his lands and livestock (1 Kgs 9:22), (4) men as servants (1 Kgs 5:13–17; 7:13–14; 9:22), (5) women (possibly concubines were used for perfumers, cooks, and bakers, 1 Kgs 4:20–27), (6) land and wealth to whom he wished (1 Kgs 9:11–14), (7) and a tax of produce and livestock (1 Kgs 4:1–27). Solomon also broke all the prohibitions in Deuteronomy 17 when he: (1) acquired many horses and chariots from Egypt (1 Kgs 10:26–29), (2) made peace with Egypt (marrying an Egyptian princess—1 Kgs 3:1), (3) acquired much wealth (1 Kgs 10:10, 14–24), and (4) acquired 700 wives and 300 concubines—many of them foreign (1 Kgs 11:1–3).26 The narratives of the Old Testament indicate that most of the kings of Israel and Judah both ruled and taxed the people in this manner.

Taxes Under Israelite Kings

Looking at the additional taxes presented by the kingship of 1 Samuel 8, the tax burden upon the people’s agricultural income (and total herds/ flocks) increased 100%—from 10% to 20% (see Table 3). The tax on their laborer capital goods (male/female/strong male laborers, donkeys/beasts of burden) went from 0% to as much as 33% of their time.27 This would both reduce the productivity and increase the cost of a slave/bondservant. Perhaps the worst tax was not really a tax but a theft of their inheritance.

The king would also take their best fields, vineyards, and orchards and not even to keep for himself, but to give away to his servants.28 This was a direct breach of the Law of inheritance (Num 27; 36). The family inheritance of lands within the land of Canaan were permanently given to each family and tribe. Naboth mentions this to Ahab and refuses to sell his vineyard for this reason (1 Kgs 21). Ahab resorts to Jezebel’s trumped up charges to kill Naboth and take not only his family inheritance but his life. It is unlikely that these “taken” lands would be returned in the Jubilee Year, because there would be no contract, just confiscation; and then the crown did not hold the lands but the one to whom the king gave them. It is also oppressive that the king will take not just any part of their inheritance, but the best part. One would think that this would be time when the Isralites would “cry out in that day” (1 Sam 8:18).

The increase in taxes was the resulting effect from the expanded government that kingship would bring.The people wanted military protection and a standing army led by their king would need to be equipped and paid. When Saul was anointed as king 3,000 men were selected to serve him as his army (1 Sam 13:2). The King’s army needed chariots, charioteers, horsemen, messengers, commanders, and blacksmiths (See Table 5, below). The king needed his own lands and fields as well as servants to work those fields, so plowmen and harvesters were needed. The army, the kings household, his field servants, and his court needed to eat, so kings took women for cooks, bakers, and even as perfumers (perhaps as concubines).29 It was not only the provision for the royal servants, but also the loss of their freedom to work when and where they wished which taxed the people.30

Royal servants increased. There are mentions of counselors, deputies, secretaries, chiefs of forced labor, “one over the household,” recorder, scribe, royal steward, overseer of the men of war, captain of the army, advisors, tutors for royal children, court prophet, bodyguards, etc. to name just a few (1 Kgs 1:38; 4:1ff; 2 Kgs 18:18; 25:19; 1 Chr 27:32). Solomon apportioned the land into tax districts whose boundaries crossed tribal lands. These were run by appointed deputies/officials responsible for taxing their district to support the king’s household and court with food and supplies for one month each year (1 Kgs 4:7ff ). Archaeology has discovered Lemelek (“for the king”) seal impressions on the handles of large storage jars in Israel which are evidence of royal taxes in the kingdom period.31 Over fifty Lemelek bullae (inscribed clay seal impressions) have also been found but may have been used for taxes in the time of Manasseh.32 Royal building projects, expanded government, and costly court expenditures were a heavy burden upon the people. So much so that Solomon’s son Rehoboam even had a tax rebellion which split the kingdom over his plan to continue Solomon’s policies (1 Kgs 12).

From a human standpoint, this is just what kings do: Tax and rule. However, while government expanded, taxation increased, and kings ignored the restrictions of Deuteronomy 17:14–18, God’s plan for Israelite kings in Deuteronomy 17 had only slightly shifted. The focus was now on the last part of the constraints for kingship: the king fearing God, keeping the Law, and having a humble heart (Deut 17:19–20). While David broke the Law in serious ways (Bathsheba affair/rape, Uriah’s murder, etc), he was repentant, and strived to follow God with a humble heart (1 Kgs 11:33). God gave David the eternal covenant of kingship in 2 Samuel 7, but it was David’s example that became the standard to which the narrator of 1–2 Kings compared all following kings. David’s heart was “wholly devoted to the Lord, his God” (1 Kgs 15:3ff ) and David “did what was right in the eyes of the Lord” (1 Kgs 15:11). David’s multiple-great-grandson, King Josiah was a good example of this, “He did right in the sight of the Lord and walked in all the way of his father David, nor did he turn aside to the right or to the left (1 Kgs 22:2).

| Property | The King Will… | The King Will… | Recipient of the Tax | Income Tax to King | Israelite Rights Violated | God’s Law Violated | Type of Tax |

| Sons | Take | Appoint as: Charioteers | King’s service | Loss of self- determination | Deut 17:16 | Labor | |

| Horsemen | King’s service | Loss of self- determination | Deut 17:16 | Labor | |||

| Heralds/ messengers | King’s service | Loss of self- determination | Labor | ||||

| Military | King’s | Loss of self- | Labor | ||||

| commanders | service | determination | |||||

| over 1000s | |||||||

| & 50s | |||||||

| plowers | King’s service | Loss of self- determination | Labor | ||||

| harvesters | King’s service | Loss of self- determination | Labor | ||||

| Military blacksmiths | King’s service | Loss of self- determination | Labor | ||||

| Daughters | Take | For perfumers | King’s harem | Loss of self- determination | Labor | ||

| For cooks | King’s harem | Loss of self- determination | Labor | ||||

| For bakers | King’s harem | Loss of self- determination | Labor | ||||

| Best Fields | Take | Give | King’s servants | Loss of Inheritance | Num 36:9* | Field (inheritance) | |

| Best Vineyards | Take | Give | King’s servants | Loss of Inheritance | Num 36:9 | Vineyard (inheritance) | |

| Best Olive Orchards | Take | Give | King’s servants | Loss of Inheritance | Num 36:9 | Orchard (inheritance) | |

| Grain Tax | Take | Tithe | King’s officers & Servants | 10% | Grain (income) | ||

| Vineyard Tax | Take | Tithe | King’s officers & Servants | 10% | Vine (income) | ||

| Male/ Female Servants Tax | Take | Impose Corvee labor | Kings court, fields, & building projects | Up to 33% of their time, | Interferes with right to work, with Service (bond-servant) contracts | Deut 5:21 | Labor |

| 1 Kings 5:13 | |||||||

| *See also Num 27:811; Lev 25:23ff. In 1 Kings 21:3, Naboth states to Ahab, “The Lord forbid that I should give you the inheritance of my fathers.” | |||||||

| Property | The King will… | The King will… | Recipient of the Tax | Income Tax to King | Israelite Rights Violated | God’s Law Violated | Type of Tax |

| Strong Laborer Tax | Take | Impose Corvee labor | Kings court, fields, & building projects | Up to 33% of their time, | Interferes with right to work, with Service (bond-servant) contracts | Deut 5:21 | Labor |

| 1 Kings 5:13 | |||||||

| Beast of Burden (Donkey) Tax | Take | Impose Corvee labor | Kings court, fields, & building projects | Up to 33% of their time, | Interferes with property ownership | Labor (capitol goods) | |

| 1 Kings 5:13 | |||||||

| Sheep/ Goats Tax | Take | Tithe | King | 10% | Interferes with property ownership | Flocks (capital goods) | |

| Israelites | Enslave | King | Loss of freedom; people become serfs |

- Jeremy Bentham, Anarchical Fallacies: being an examination of the Declaration of Rights issued during the French Revolution, in Nonsense upon Stilts: Bentham, Burke, and Marx on the Rights of Man, edited by Jeremy Waldron (London: Methuen, 1987), 46–69. ↩︎

- According to the U.S. department of Treasury website, the government levies taxes upon individuals and business in order “to protect individual freedoms and to promote the well-being of society as whole.” http://www.treasury.gov/resource-center/faqs/Taxes/Pages/ economics.aspx (Accessed 22 May 2017). ↩︎

- Ronald M. Green, “Ethical Issues in Taxation,” in The Future of Tax Policy in New Hampshire (Durham: University of New Hampshire Center for Educational Field Services, 1983), 12 [12–25]. ↩︎

- Menachem Elon, ed. “Taxation,” in The Principles of Jewish Law ( Jerusalem: Keter, 1975), 663; Robert A. Oden Jr., “Taxation in Biblical Israel,” http://www.michaelsheiser.com/ TheNakedBible/Taxation%20in%20biblical%20Israel.pdf, 163 (Accessed 22 May 2017).. ↩︎

- Jepthah’s appointment as Judge by the elders of Gilead is one example of this procedure ( Judg 11) and the elders request for a king in 1 Sam 8 is another (see also the elders and Rehoboam, 1 Kgs 12:6). ↩︎

- This was done at Alalakh (no. 15) and Ugarit (no. 16.132, 16.239), where the mariannu “chariot owner” supported the king through military service. D.J. Wiseman, The Alalakh Tablets (London: The British Institute of Archaeology at Ankara, 1953), 2; Isaac Mendelsohn, “Samuel’s Denunciation of Kingship in the Light of the Accadian Documents from Ugarit,” BASOR 143 (1956): 17–18; Jean Nougayrol, PRU, tome 3, Mission de Ras Shamra, no. 5 (Paris: Imprimerie Nationale, 1955), xiii; Jean Nougayrol, PRU, tome 4, Mission de Ras Shamra, no. 9 (Paris: Imprimerie Nationale, 1956); Charles Virolleaud, PRU, tome 2, Mission de Ras Shamra, no. 7 (Paris: Imprimerie Nationale, 1957); Charles Virolleaud, PRU, tome 5, Mission de Ras Shamra, no. 11 (Paris: Imprimerie Nationale, 1965); John Huehnergard, The Akkadian of Ugarit (Atlanta: Scholars, 1989), 286–301. ↩︎

- Adoni-bezek of Jerusalem, Judg 1:5; Edom, Gen 36:31; Og of Bashan, Num 21:33. ↩︎

- This text is dated to 1000–700 B.C. W.G. Lambert, “Advice to a Prince,” in Babylonian Wisdom Literature, edited and translated W. G. Lambert (Winona Lake: Eisenbrauns, 1996), 110–15. ↩︎

- The book of Deuteronomy is in the form of a suzerainty covenant, meaning an overlord/king imposes his covenant upon a vassal king. Deuteronomy established God as king over Israel. Meredith G. Kline, Treaty of the Great King (Grand Rapids: Eerdmans, 1963). ↩︎

- As Paul stated, “The Law came in so that the transgression would increase; but where sin increased, grace abounded all the more” Rom 5:20. ↩︎

- As Jeremy Bentham states, “from real laws come real rights,” but “all rights are made at the expense of liberty.” Bentham, Anarchical Fallacies, 7, 14. ↩︎

- While the poor may have rights, it is the Landowner/man of means who has the obligation. ↩︎

- James Sadowsky, “The Economics of Sin Taxes,” http://www.acton.org/pub/religion- liberty/volume-4-number-2/economics-sin-taxes (Accessed 23 May 2017). ↩︎

- These categories are found both in the appendix and on table 3. For appendix see https://swbts.edu/sites/default/files/images/content/docs/journal/59_2/SWJT_59_2_ Mitchell_Appendix.pdf ↩︎

- Ludwig Koehler, et al., The Hebrew and Aramaic Lexicon of the Old Testament

(HALOT) (Leiden: E.J. Brill, 1994–2000), 907. ↩︎ - Grapevines are one example where some clusters ripen later. See the appendix for these laws. ↩︎

- In Table 2, each square is counted as 10 m on a side. So the largest square is 10,000 m2. In 2A, each square is 100 m2 out of the possible total; for tabulation, each corner is taken only half harvested; In Table 2B, the edge left unharvested is proposed at 1 m wide all around the perimeter of the field. So in the largest field, a 360 m perimeter multiplied by 1 m wide strip = 360 m2. This divided by the 10,000 m2 area leaves the percentage as shown. ↩︎

- See Deut 6:5 (Love God) and Lev 19:18 (love your neighbor as yourself ); Jesus summarizes these when He says, “On these two commandments depend the whole Law and the Prophets” (Matt 22:35–40). ↩︎

- Exod 3:16, 18.; 4:29; 12:21; 17:5–6; Lev 4:15. ↩︎

- This is clearly revealed in the people’s response in 1 Sam 8:19–20. The phrase ֺוִים ַּכּג is found in Ezek 20:32; Deut 8:20; and 2 Kings 17:11 in the context of serving idols. ↩︎

- The word mišpāṭ may mean “judgment, dispute, legal claim, claim, measure, or law.” HALOT, 651–52. Most scholars take this term as “legal claim, right, or custom” leading to a translation of the term mišpāṭ hammelek as “manner of the king” (KJV, J.P. Fokkelman, Narrative Art and Poetry in the Books of Samuel: A Full Interpretation Based on the Stylistic and Structural Analyses, Vol. 4, Vow and Desire [I Sam. 1–12] [Assen: Van Gorcum, 1993], 352; Lyle M. Eslinger, Kingship of God in Crisis: A Close Reading of 1 Samuel 1–12 [Decatur, GA: Almond, 1985], 269); Eliezer Berkovits, “The Biblical Meaning of Justice,” Judaism 18 (1969): 199; “behavior of the king” (NKJV), “procedure of the king” (NASB), “ways of the king” (NRSV, ESV; Walter Brueggemann, First and Second Samuel, Interpretation [Louisville: John Knox, 1990], 63; Robert P. Gordon, I & II Samuel: A Commentary [Grand Rapids: Regency Reference Library, 1988], 110); “custom of the king” (Moshe Garsiel, The First Book of Samuel: A Literary Study of Comparative Structures, Analogies and Parallels [Ramat-Gan: Revivim, 1985], 58); “practice of the king’ ( JPS); “rights and duties of the king,” (Herbert Marks and Robert Polzin, eds., Samuel and the Deuteronomist: A Literary Study of the Deuteronomic History [Bloomington: Indiana University Press, 1993], 85); “justice of the king,” (P. Kyle McCarter, Jr., I Samuel: A New Translation with Introduction, Notes and Commentary, The Anchor Bible. [Garden City, NY: Doubleday, 1979], 153); “ordinance of the king”(Diana Vikander Edelman, King Saul in the Historiography of Judah [Sheffield: Sheffield Academic, 1991], 40–41. This view takes the mišpāṭ hammelek as the expected equivalent of Deut 17:14–20); “rule of the king,” (Shemaryahu Talmon, “‘The Rule of the King:’ 1 Samuel 8:4–22,” in King, Cult and Calendar in Ancient Israel [ Jerusalem: Magnes, 1986], 61.); “what the king will do” (NIV). See also, Eric Mitchell, “‘Give Us A King:’ The Triumph of Satire in 1 Samuel 8,” ( PhD diss., The Southern Baptist Theological Seminary, 2002). ↩︎

- Claus Westermann, Basic Forms of Prophetic Speech, 142, 170–71. Eric Mitchell, “Give Us a King,” 168, 188. ↩︎

- Edwin Marshall Good, Irony in the Old Testament, Bible and Literature Series 3, (Sheffield: Almond, 1981), 27. ↩︎

- Mitchell, “Give Us A King,” 76. ↩︎

- Saul was a false-start at kingship. He is presented in the narrative of 1 Sam—in almost every instance—in a negative light. Even the positive narratives have a subtle negative portent or intention. He fails in too many ways to mention here. ↩︎

- However, Solomon was never condemned by God for his wealth (instead, God gave him wealth, 1 Kgs 3:13; Deut 17:17). Neither was Solomon reproached for his horses and chariots (Deut 17:16) or for acquiring a great many wives (Deut 17:17). It was Solomon’s foreign wives (cf. Deut. 7:3) who led him into idolatry, that caused the negative editorial comment about Solomon’s reign (1 Kgs 11:1–13). ↩︎

- In 1 Kgs 5:13, Solomon levied a labor force of 30,000 from all Israel, but 1 Kgs 9:21–22 indicates that the non-Israelites left in the land were the forced laborers while the Israelites were only Solomon’s leaders (reflecting the case in 1 Sam 8:16). ↩︎

- In the Alalakh tablets and at Ugarit the king seized and redistributed land. Alalakh (no. 17, 238–[269]–286, 290–299, 410). ↩︎

- Peter Ackroyd (First Book of Samuel, 72) takes “perfumers” as a euphemism for concubines. David had concubines who kept his house (2 Sam 12:11; 16:21). Saul had only one concubine presented in the Biblical text (2 Sam 3:7). Wives/women often prepared the food. Sarah baked for the three strangers (Gen 18:6) and David’s daughter Tamar made cakes and baked them for her brother Amnon (2 Sam 13:8). Perfumes were used in ancient Israel. Scented oils were used for skin ointments, to cover odors, as well as for religious purposes. A perfumer blended the oils and ingredients to produce these. Philip J. King and Lawrence E. Stager, Life in Biblical Israel, Library of Ancient Israel (Louisville: Westminster John Knox, 2001), 50, 65, 280–81. ↩︎

- David was pressed into Saul’s service (1 Sam 16:17–22; 18:2); and Jeroboam was pressed into Solomon’s service (1 Kings 11:28). ↩︎

- Many from the time of Hezekiah. About two thousand seal impressions have been

found. ↩︎ - Gabi Barkay’s Temple Mount Sifting Project discovered a seventh century B.C. bulla

inscribed in paleo-Hebrew “Gibeon, for the king.” 19 cities are identified in Lmlk bullae which represent nine of the 12 Judahite districts mentioned in Josh 15:20–63. Barkay ties these bullae to taxes imposed by king Manasseh. Biblical Archaeology Society, Bible History Daily, http://www.biblicalarchaeology.org/daily/ancient-cultures/ancient-israel/how-ancient-taxes- were-collected-under-king-manasseh/ (Accessed 24 May 2017). ↩︎